Submitted by Doug Casey via InternationalMan.com,

A meme is now circulating that gold is the investment equivalent of a pet rock, and that the smart investor should sell gold, and buy stocks. That’s a ridiculous notion. In fact, if you believe in buying low and selling high, this is the time to buy gold, and sell stocks.

It pays to remain as objective as you can be when analyzing any investment. People have a tendency to fall in love with an asset class, usually because it’s treated them so well. We saw that happen most recently with Internet stocks in the late ’90s and with houses up to 2007. Investment bubbles are driven primarily by emotion, although there’s always some rationale for the emotion to latch on to. Perversely, when it comes to investing, reason is recruited mainly to provide cover for passion and preconception.

In the same way, people tend to hate certain investments unreasonably, usually at the bottom of a bear market, after they’ve lost a lot of money; even thinking about the asset means reliving the pain and loss. Love-and-hate cycles occur for all investment classes.

But there’s only one investment I can think of that many people either love or hate reflexively, almost without regard to market performance: gold. And, to a lesser degree, silver. It’s strange that these two metals provoke such powerful psychological reactions - especially among people who dislike them. Nobody has an instinctive hatred of iron, copper, aluminum, or cobalt. The reason, of course, is that the main use of gold has always been as money. And people have strong feelings about money. Let’s spend a moment looking at how gold’s fundamentals fit in with the psychology of the current market.

What Gold Is - and Why It’s Hated

Let me first disclose that I’ve always been favorably inclined toward gold, simply because I think money is a good thing. Not everyone feels that way, however. Some, with a Platonic view, think that money and commercial activity in general are degrading and beneath the “better” sort of people - although they’re a little hazy about how mankind rose above the level of living hand-to-mouth, grubbing for roots and berries. Some think it’s “the root of all evil,” a view that reflects a certain attitude toward the material world in general. Some better-informed people (who have actually read Paul of Tarsus) think it’s just the love of money that’s the root of all evil. Some others see the utility of money, but think it should be controlled somehow - as if only the proper authorities know how to manage the dangerous substance.

From an economic viewpoint, however, money is just a medium of exchange and a store of value. Efforts to turn it into a political football invariably are signs of a hidden agenda, or perhaps a psychological aberration.

But, that said, money does have a moral as well as an economic significance. And it’s important to get that out in the open and have it understood. My view is that money is a high moral good. It represents all the good things you hope to have, do, and provide in the future. In a manner of speaking, it’s distilled life. That’s why it’s important to have a sound money, one that isn’t subject to political manipulation.

Over the centuries, many things have been used as money, prominently including cows, salt, and seashells. Aristotle thought about this in the 4th century BCE and arrived at the five characteristics of a good money:

It should be durable (which is why, say, wheat isn’t a good money - it rots).

It should be divisible (which is why artwork isn’t a good money - you can’t cut up the Mona Lisa for change).

It should be convenient (which is why lead isn’t a good money - it just takes too much to be of value).

It should be consistent (which is one reason why land can’t be money - each piece is different).

And it should have value in itself (which is why paper money leads to trouble).

Of the 92 naturally occurring elements, gold has proved the best money (silver is second). It’s not magic or superstition any more than it is for iron to be best for building bridges and aluminum for building airplanes.

Of course, we do use paper as money today, but only because it recently served as a receipt for actual money. Paper money (currency) historically has a half-life that depends on a number of factors. But it rarely lasts longer than the government that issues it. Gold is the best money because it doesn’t need to be “faith based” or rely on a government.

There’s much more that can be said on this topic, and it’s important to grasp the essentials in order to understand the controversy about whether now is a good time to buy. But this isn’t the place for an extended explanation.

Keep these things in mind, though, as you listen to the current blather from talking heads about where gold is going. Most of them are just journalists, reporters that are parroting what they heard someone else say. And the “someone else” is usually a political apologist who works for a government. Or a hack economist who works for a bank, the IMF, or a similar institution with an interest in the status quo of the last few generations. You should treat almost everything you hear about finance or economics in the popular media as no more than entertainment.

So, let’s take some recent statements, assertions, and opinions that have been promulgated in the media and analyze them. Many impress me as completely uninformed, even stupid. But since they’re floating around in the infosphere, I suppose they need to be addressed.

Misinformation and Disinformation

Let’s examine some memes floating around.

“Gold is expensive.”

This objection is worth considering - for any asset. In fact, it’s critical. We can determine the price of almost anything; that’s easy. The hard part is figuring out its value. From the founding of the U.S. until 1933, the dollar was defined as 1/20th of an ounce of gold. From 1933 to 1971, it was redefined as 1/35th of an ounce. After the 1971 dollar devaluation, the official price of the metal was raised to $42.22 - but that official number is meaningless, since nobody buys or sells the metal at that price. More importantly, people have gotten into the habit of giving the price of gold in dollars, rather than the value of the dollar in gold. But that’s another subject.

Here’s the crux of the argument. Before the creation of the Federal Reserve in 1913, a $20 bill was just a receipt for the deposit of one ounce of gold with the Treasury. The U.S. official money supply equated more or less with the amount of gold. Now, however, dollars are being created by the trillion, and nobody really knows how many more of them are going to be shazammed into existence.

It’s hard to determine the value of anything when the inch marks on your yardstick keep drifting closer and closer together.

“The smart money is long gone from gold.”

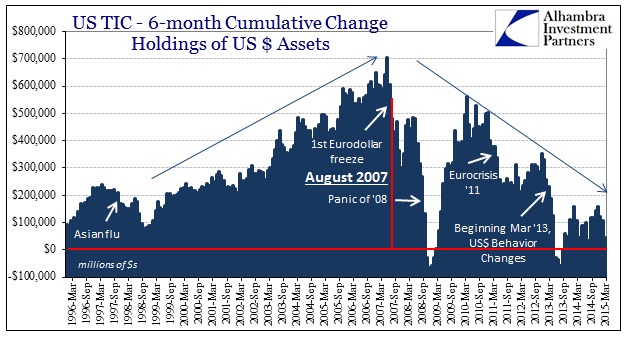

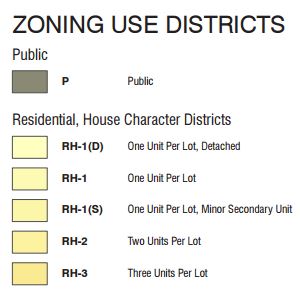

This is an interesting assertion that I find is based on nothing at all. Who really is the “smart money”? How do you really know that? And how do you know exactly what they own (except for, usually, many months after the fact) or what they plan on buying or selling? The fact is that very few billionaires (John Paulson perhaps being the best known of them) have declared a major position in the metal. Gold is only a tiny proportion of the financial world’s assets, both absolutely or relative to where it has been in the past:

![]()

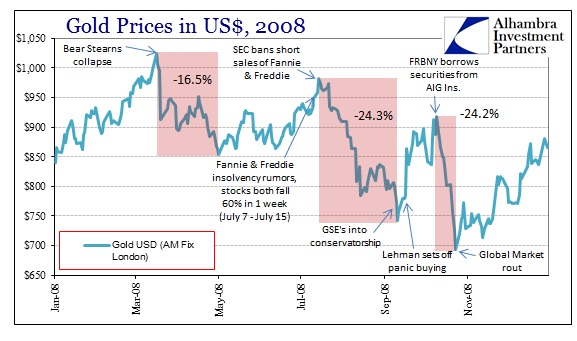

“Gold is risky.”

Risk is largely a function of price. And, as a general rule, the higher the price, the higher the risk, simply because supply is likely to go up and demand down - leading to a lower price. So, yes, gold is riskier at $1,100 than it was at $700 or at $200. But even when it was at $35, there was a well-known financial commentator named Eliot Janeway (I always thought he was a fool and a blowhard) who was crowing that if the U.S. government didn’t support it at $35, it would fall to $8.

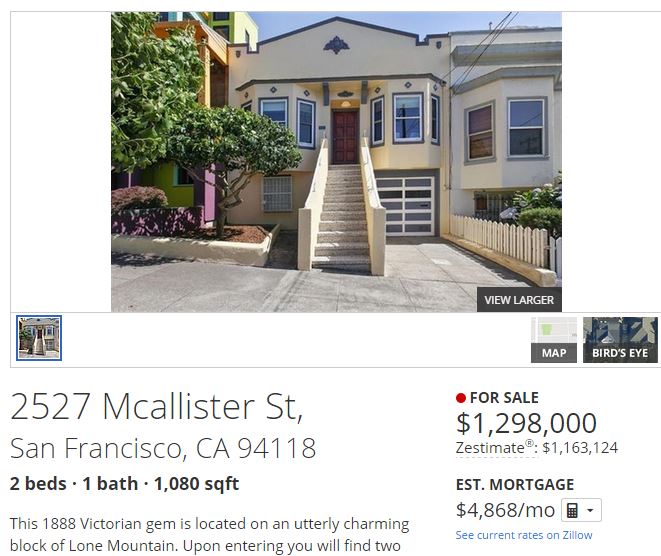

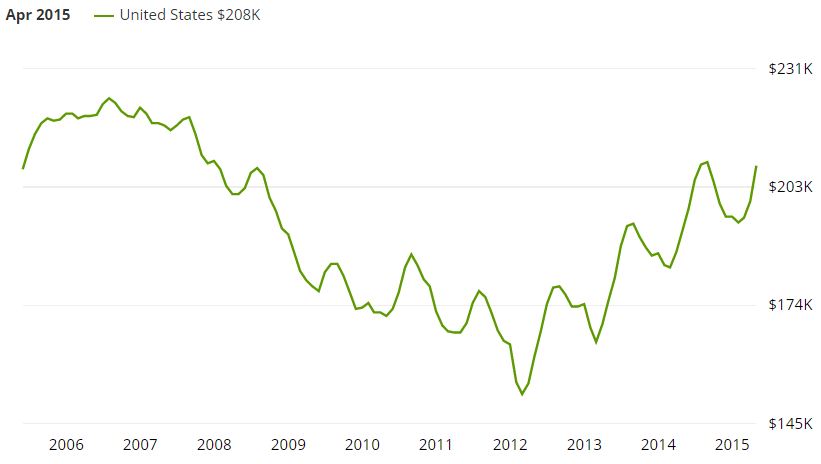

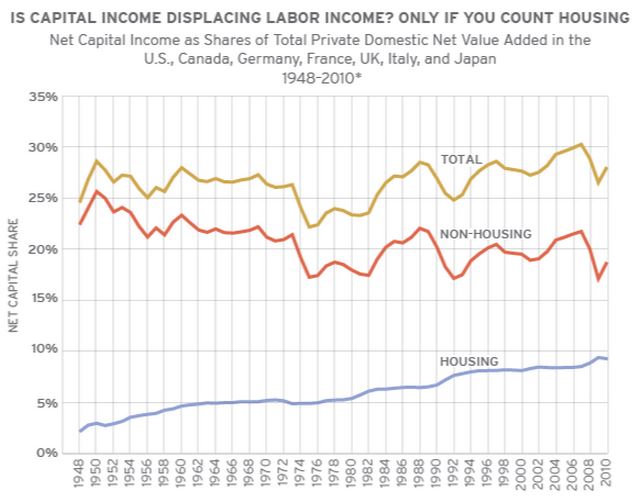

In any event, risk is relative. Stocks are very risky today. Bonds are ultrarisky. Real estate, at least in many major cities, is in a near mania. And the dollar, although it’s cyclically popular, is on its way to reaching its intrinsic value. In fact, stock, bonds, property, and the dollar are all in bubble territory.

Yes, gold is risky now. But it is actually much less risky than most alternatives.

“Gold pays no interest.”

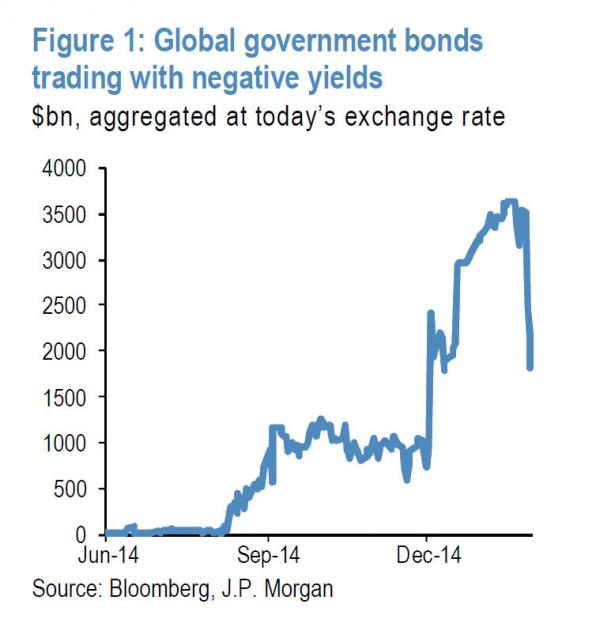

This is kind of true. But only in the sense that a $100 bill pays no interest. You can get interest from anything that functions as money if it is lent out. Interest is the time premium of money. You will not get interest from either your $100 or your gold unless you lend them to someone. But both the dollars and the gold will earn interest if you lend them out. The problem is that once you make a loan (even to a bank, in the form of a savings account), you may not even get your principal back, much less the interest. And, of course, many banks around the world now pay negative interest for loaning them money - an absurd inversion of reality.

“Gold pays no dividends.”

Of course it doesn’t. It also doesn’t yield chocolate syrup. It’s a ridiculous objection, because only corporations pay dividends. It’s like expecting your Toyota in the driveway to pay a dividend, when only the corporation in Japan can do so. But if you want dividends related to gold, you can buy a successful gold mining stock.

“Gold costs you insurance and storage.”

This is arguably true. But it’s really a sophistic misdirection to which many people uncritically nod in agreement. You may very well want to insure and professionally store your gold. Just as you might your jewelry, your artwork, and most valuable things you own. It’s even true of the share certificates for stocks you may own. It’s true of the assets in your mutual fund (where you pay for custody, plus a management fee).

You can avoid the cost of insurance and storage by burying gold in a safe place - something that’s not a practical option with most other valuable assets. But maybe you really don’t want to store and insure your gold, because the government may prove a greater threat than any common thief. And if you pay storage and insurance, they’ll definitely know how much you have and where it is.

“Gold has no real use.”

This assertion stems from a lack of knowledge of basic chemistry as well as economics. Yes, of course people have always liked gold for jewelry, and that’s a genuine use. It’s also good for dentistry and micro-circuitry. Owners of paper money, however, have found the stuff to be absolutely worthless hundreds of times in scores of countries.

In point of fact, gold is useful because it is the most malleable, the most ductile, and the most corrosion resistant of all metals. That means we’re finding new uses for it literally every day. It’s also the second-most conductive of heat and electricity, and the second-most reflective (after silver). Gold is a hi-tech metal for these reasons. It can do things no other substance can and is part of the reason your computer works so well.

But all these reasons are strictly secondary, because gold’s main use has always been (and I’ll wager will be again) as money. Money is its highest and best use, and it’s an extremely important one.

“The U.S. can, or will, sell its gold to pay its debt, depressing the market.”

I find this assertion completely unrealistic. The U.S. government reports that it owns 265 million ounces of gold. Let’s say that’s worth about $300 billion right now. I’m afraid that’s chicken feed in today’s world. It’s only half of this year’s federal deficit alone. It’s only half of one year’s trade deficit. It represents perhaps only 2% of the dollars outside the U.S. The U.S. government may be the largest holder of gold in the world, but it owns less than 5% of the approximately 6 billion ounces above ground.

From the ’60s until about 2000, most Western governments were selling gold from their treasuries, working on the belief it was a “barbarous relic.” Since then, governments in the advancing world - China, India, Russia, and many other ex-socialist states - have been buying massive quantities.

Why? Because their main monetary asset is U.S. dollars, and they have come to realize those dollars are the unbacked liability of a bankrupt government. They’re becoming hot potatoes, Old Maid cards. But the dollars can be replaced with what? Sovereign wealth funds are using them to buy resources and industries, but those things aren’t money. And in the hands of bureaucrats, they’re guaranteed to be mismanaged. I expect a great deal of gold buying from governments around the world over the next few years. And it will be at much higher dollar prices.

“High gold prices will bring on huge new production, which will depress its price.”

This assertion shows a complete misunderstanding of the nature of the gold market. Gold production is now about 90 million ounces per year and is trending down. That’s partly because, at high prices, miners tend to mine lower-grade ore. And partly because the world has been extensively explored, and most large, high-grade, easily exploited resources have already been put into production. And partly because most production is now unprofitable. Miners aren’t putting any new mines into production.

But new production is trivial relative to the 6 billion ounces now above ground, which only increases by about 1.3% annually. Gold isn’t consumed like wheat or even copper; its supply keeps slowly rising, like wealth in general. What really controls gold’s price is the desire of people to hold it, or hold other things - new production is a trivial influence.

That’s not to say things can’t change. The asteroids have lots of heavy metals, including gold; space exploration will make them available. Gigantic amounts of gold are dissolved in seawater and will perhaps someday be economically recoverable with biotech. It’s now possible to transmute metals, fulfilling the alchemists’ dream; perhaps someday this will be economic for gold. And nanotech may soon allow ultralow-grade deposits of gold (and every other element) to be recovered profitably. But these things need not concern us as practical matters for years to come.

“You should have only a small amount of gold, for insurance.”

This argument is made by those who think gold is only going to be useful if civilization breaks down, when it could be an asset of last resort. In the meantime, they say, do something productive with your money…

This is poor speculative theory. The intelligent investor allocates his funds where it’s likely they’ll provide the best return, consistent with the risk, liquidity, and volatility profile he wants to maintain. There are times when you should be greatly overweight in a single asset class - sometimes stocks, sometimes bonds, sometimes real estate, sometimes what-have-you. From 1971 to 1980 and 2001 to 2011, it was wise to be hugely overweight gold. From 1981 to 2000 and 2011 to the present, it was wise to only keep an insurance position. Right now, you again want an overweight position. The idea of keeping a constant, but insignificant, percentage in gold impresses me as poorly thought out.

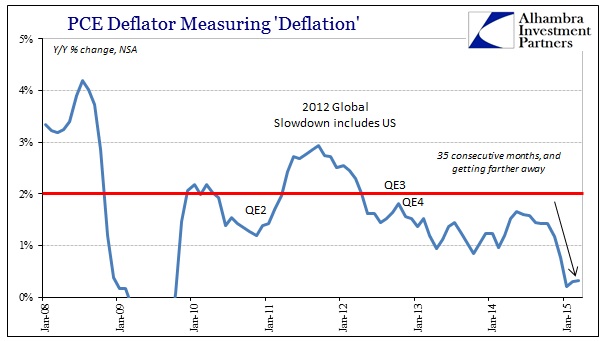

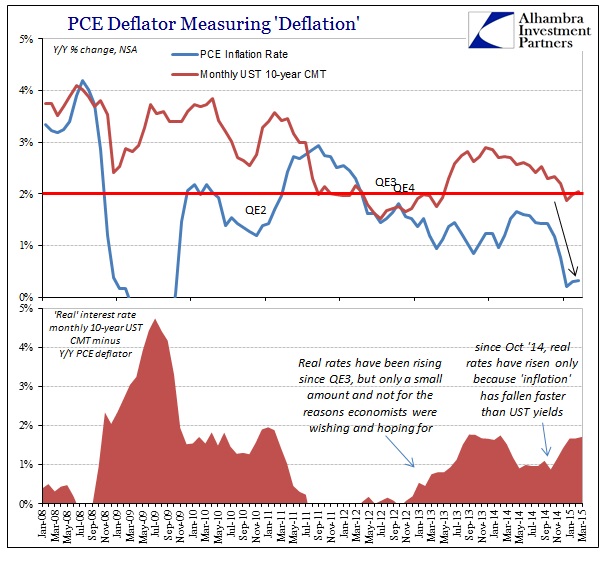

“Interest rates are near zero; gold will fall as they rise.”

In principle, as interest rates rise, people tend to prefer holding currency deposits. So they tend to sell other assets, including gold, to own interest-earning cash. But there are other factors at work. What if the nominal interest rate is 20%, but the rate of currency depreciation is 40%? Then the real interest rate is minus 20%. This is more or less what happened in the late ’70s, when both nominal rates and gold went up together. Right now governments all over the world are suppressing rates even while they’re greatly increasing the amount of money outstanding; this will eventually (read: soon) result in both much higher rates and a much higher general price level. At some point, high real rates will be a factor in ending the gold bull market, but that time is many months or years in the future.

“Gold sentiment is dead.”

That’s quite true. Gold sentiment is not just quite subdued among the public; most of them barely know the metal even exists.

You’ll know sentiment is at a high when major brokerage firms are hyping newly minted gold products, and Slime Magazine (if it still exists) has a cover showing a golden bull tearing apart the New York Stock Exchange. We’re a long way from that point. When it arrives, I hope to sell my gold and buy the NYSE.

“Mining stocks are risky.”

This is absolutely true. In general, mining is a horrible business. It requires gigantic fixed capital expense to build a mine, but only after numerous, expensive, and unpredictable permitting issues are handled. Then, the operation is immovable and subject to every political risk imaginable, not infrequently including nationalization. Add in continual and formidable technical issues of every description, compounded by unpredictable fluctuations in the price of the end product. Mining is a horrible business, and you’ll never find Graham-Dodd investors buying mining stocks.

All these problems (and many more that aren’t germane to this brief article), however, make mining stocks excellent speculative vehicles from time to time. Like right now.

“Mineral exploration stocks are very, very risky.”

This is very, very true. There are thousands of little public companies, and some are just a couple steps up from a prospector wandering around with a mule. Others are fairly sophisticated, hi-tech operations. Exploration companies are often classed with mining companies, but they are actually very different animals. They aren’t so much running a business as engaging in a very expensive and long-odds treasure hunt.

That’s the bad news. The good news is that they are not only risky but extraordinarily volatile. The most you can lose is 100%, but the market cyclically goes up 10 to 1, with some stocks moving 1,000 to 1. That kind of volatility can be your best friend. Speculating in these issues, however, requires both expertise and a good sense of market timing. But they’re likely to be at the epicenter of the gold bubble when it arrives - even though few actually have any gold, except in their names.

“Warren Buffett is a huge gold bear.”

This is true, but irrelevant - entirely apart from suffering from the logical fallacy called “argument from authority.” Nonetheless, when the world’s most successful investor speaks, it’s worth listening. Here’s what Buffett said about gold in an interview with Ben Stein, another goldphobe:

You could take all the gold that’s ever been mined, and it would fill a cube 67 feet in each direction. For what that’s worth at current gold prices, you could buy all - not some, all - of the farmland in the United States. Plus, you could buy 10 ExxonMobils, plus have $1 trillion of walking-around money. Or you could have a big cube of metal. Which would you take? Which is going to produce more value?

I’ve long considered Buffett an idiot savant - a genius at buying stocks but at nothing else. His statement is accurate, but completely meaningless. The same could be said of the U.S. dollar money supply - or even of the world inventory of steel and copper. These things represent potential, but are not businesses or productive assets in themselves. Buffett is certainly not stupid, but he’s a shameless and intellectually dishonest sophist, despite his disarming and avuncular demeanor. And although a great investor, he’s neither an economist nor someone who believes in free markets.

“Gold is a religious statement.”

Actually, since most religions have an otherworldly orientation, they’re at least subtly (and often stridently) anti-gold. But it is true that some promoters of gold seem to have an Elmer Gantry-like style. That, however, can be said of True Believers in anything, whether or not the belief itself has merit. In point of fact, I think it’s more true to say goldphobes suffer from a kind of religious hysteria, fervently believing in collectivism in general and the state in particular, with no regard to counterarguments. Someone who understands why gold is money and why it is currently a good speculative vehicle is hardly making a religious statement. More likely, he’s taking a scientific approach to economics and thinking for himself.

So Where Are We?

So, these are some of the more egregious arguments against gold that are being brought forward today. Most of them are propounded by knaves, fools, or the uninformed.

My own view should be clear from the responses I’ve given above. But let me clarify it a bit further. Historically - actually just up until the decades after World War I, when world governments started issuing paper currency with no relation to gold - the metal was cash, and it was used as money everywhere, on a daily basis. I believe that will again be the case in the fairly near future.

The question is: At what price will that occur, relative to other things? It’s not just a question of picking a dollar price, because the relative value of many things - houses, food, commodities, labor - has been distorted by a very long period of currency inflation, increased taxation, and very burdensome regulation that started at the beginning of the last depression. Especially with the fantastic leaps in technology now being made and breathtaking advances that will soon occur, it’s hard to be sure exactly how values will realign after the Greater Depression ends. And we can’t know the exact manner in which it will end. Especially when you factor in the rise of China and India.

A guess? I’ll say the equivalent of about $5,000 an ounce of today’s dollars. And I feel pretty good about that number, considering how shaky the world financial situation is, and that we are - I believe - about to enter another gold bull market. Classic bull markets have three stages. We’re still in the “Stealth” stage - when few people even remember gold exists, and those who do mock the idea of owning it. Next, we’ll enter the “Wall of Worry” stage, when people notice it and the bulls and bears battle back and forth. At some point, we’ll enter the “Mania” stage - when everybody, including governments, is buying gold, out of greed and fear. But also out of prudence.

The policies of Bernanke, Yellen, and Obama - and also of almost every other central bank and government in the world - are not just wrong. These people are, perversely, doing just the opposite of what should be done to cure the problems that have built up over decades. One consequence of their actions will be to ignite numerous other bubbles in various markets and countries. I expect the biggest bubble will be in gold, and the wildest one in mining and exploration stocks.

When will I sell out of gold and gold stocks? Of course, they don’t ring a bell at either the top or the bottom of the market. But I expect to be a seller when there really is a bubble, a mania, in all things gold related. There’s a good chance that will coincide to some degree with a real bottom in conventional stocks. I don’t know what level that might be on the DJIA, but I think its average dividend yield might then be in the 6% to 8% area.

The bottom line is that gold and its friends are again cheap, and they have a long way - in both time and price - to run. Until they’re done, I suggest you be right and sit tight.